At Insurance Advisernet Australia we are committed to providing you with excellent customer service and quality products. If you believe that we have not delivered in a particular area we would like to hear your comments.

Complaints are an important part of maintaining and improving our standards. If you have any complaints regarding service or products, please contact the people who provided your initial service.

If your complaint is not resolved to your satisfaction or you do not wish to contact the people who provided your initial service, you can contact us using the following methods:

Contact Method |

Description |

|---|---|

ONLINE |

Complete a Feedback Form |

PHONE |

*Free Call: 1300 366 085 |

|

|

Email feedback@iaa.net.au |

FAX |

Print a Feedback Form and fax to 02 9954 1809 |

|

|

Print a Feedback Form and mail to the following address: Insurance Advisernet Australia Pty Ltd Complaints Officer PO Box 633, NORTH SYDNEY, NSW, 2059 |

If you are of a Non-English speaking background or, if you have special needs that require assistance when dealing with us, we are happy to assist by engaging translators or other specialised support services such as the National Relay Service.

We are committed to supporting clients who may be experiencing vulnerability. Vulnerability may be due to a range of factors including (but not limited to); age, disability, mental and/or physical health conditions, family and domestic violence, financial distress and other personal or financial circumstances causing significant detriment. We will do our best to identify any vulnerability, however, we encourage you to communicate with us and advise if you are experiencing vulnerability as we may not otherwise become aware of these circumstances if you do not tell us.

Where we identify that additional support or assistance is needed, we will work with you to find a suitable way to proceed, whilst at all times respecting your right to privacy and self-advocacy. This additional support may include seeking support from a third party, for example, a lawyer, interpreter or friend and we will make reasonable accommodations to allow for this. In some cases, we may be able to assist by referring you to people or services with specialist training and experience. More information can be found on our ‘Client Support’ page.

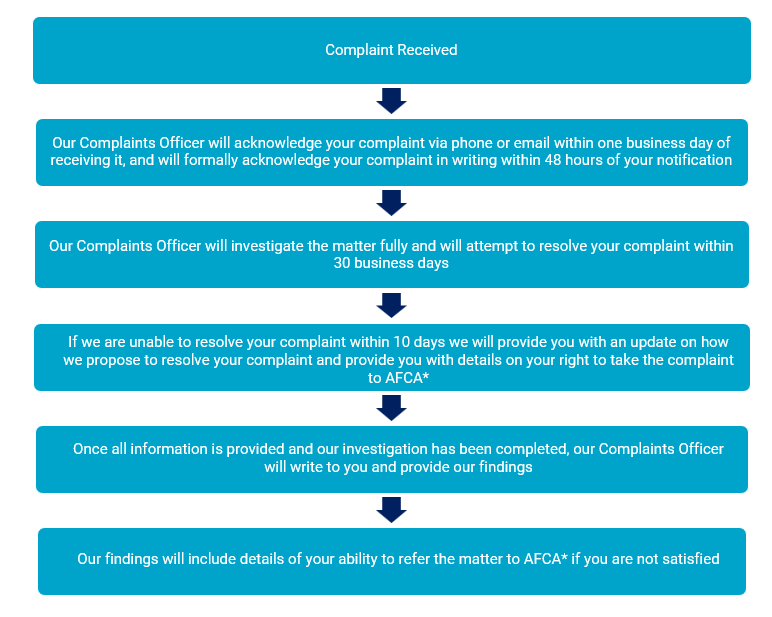

We handle Complaints openly and transparently and will endeavour to resolve your complaint fairly and within 30 days. If we have not resolved your complaint within 10 days we will provide you with a written update as to the reason for the delay, what action is underway to resolve your complaint and advise you of the anticipated timeframe for a response.

In handling your complaint, there are a number of remedies available to us, including but not limited to;

- An apology or explanation

- Liaison with insurers and/or premium funders to find a mutually agreeable outcome to your complaint

- Claims advocacy including support to address your complaint via the Insurer IDR process.

If you are not satisfied with the final complaint outcome, we subscribe to Australian Financial Complaints Authority (AFCA) complaints resolution scheme, which handles complaints against insurance brokers relating to a variety of small business and domestic policies. You can refer your complaint to the AFCA who will conciliate with a view to seeking a solution that is acceptable to both parties.

*AFCA – Australian Financial Complaints Authority